Taxation Law no. 6 of 2025

Law No. 6 of 2025 – Regarding some tax incentives and concessions for projects with an annual business volume not exceeding twenty million pounds.

Who qualifies?

All small and medium enterprises (SMEs) with annual revenues below EGP 20 million qualify, including professional or commercial activities, whether tax-registered or not.

Exclusions:

- Entities deriving 90% of revenue from only one or two clients;

- And businesses that artificially fragment to gain eligibility.

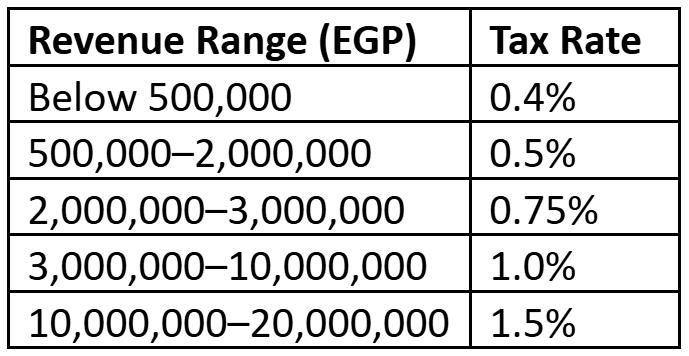

Simplified Income Tax on Turnover

Eligible SMEs pay income tax as a fixed percentage of annual turnover:

If turnover exceeds EGP 20 m by up to 20% in any one year within the first five years, the business may retain the 1.5% rate for an additional year; if exceeded or repeated, benefits end from the next year.

Dividend Tax Exemption

A key highlight: dividend distributions from eligible SMEs are completely exempt from withholding or other dividend taxes.

Other Tax Exemptions & Simplified Compliance

Exemptions from state development fees, stamp duty, notarization, and registration fees for company setup and financing, and capital gains tax on sale of fixed assets/equipment.

SMEs can use simplified accounting (avoiding formal bookkeeping) and file via stand-alone simplified forms issued by the Minister of Finance.

VAT returns are filed quarterly instead of monthly, and VAT inspections are deferred for five years.

Similarly, corporate tax and payroll declarations follow simplified templates and timing, with tax audits deferred for five years for compliant SMEs.

Commitment Period & Compliance Traps

Once admitted to this regime, businesses may not withdraw within the first five years of benefit.

Non-compliance—such as failure to join e-invoicing systems, late filings, or top-line manipulation can lead to revocation of benefits.

Example Let’s say a company posts an annual turnover of EGP 8 million, distributing dividends of EGP 1 million:

According to Law no. 6 of 2025:

Corporate income tax = 1% × 8,000,000 = EGP 80,000

No dividend tax applies on the 1 million distributions.

According to the Egyptian Tax Law:

Corporate and dividend tax could exceed 10–22% on taxed profits and distributions combined.

Our Recommendations

Law No. 6 of 2025 simplifies tax obligations for SMEs (turnover up to EGP 20,000,000) and offers a full exemption on dividend distributions. Shareholders can now receive profit payouts tax-free, saving significant costs. We highly recommend submitting the benefit request to the Tax Authority promptly and ensuring digital compliance with e-invoicing for eligibility.

- Review historical turnover to confirm eligibility of the benefits of Law no. 6 of 2025.

- Submit the benefits application as early as possible, post-March 1, 2025.

- Ensure full adoption of e-invoicing and e-receipt systems, and timely tax filings.

- Caution against structural reorganizations designed to fragment turnover artificially.

- Monitor thresholds (especially the EGP 20 m cap + 20% buffer) to preserve eligibility.